VEDANTA

TRUE SPEAKING TREE

• Politics & Society• International• The earth• Entertainment• Health & Wellness• Science & Technology• Economy• Sports• Story• Current Affairs

Friday, 21 July 2023

10 Best Highest Paying Dividend Stocks, Given Upto 31% Dividend, Vedanta & Hindustan Zinc Are In Top

Thursday, 4 May 2023

TO RESEARCHING A SMALL CAP COMPANY

· If they are paying dividend then move on

· If they are not paying dividend then look for ROe and ROCE

· If ROCE and ROe above 15 then move on

· If Roe and ROCE below 15 then check it’s CAPEX.

· If it has done CAPEX then ROCE and Roe will be lower for few years.

· If it doesn’t have CAPEX but low Roe and ROCE then stop there.

Wednesday, 3 May 2023

6 REASONS to Avoid : EPFO Higher Pension

Why should

you stay away from EPFO Higher Pension?

According

to the Supreme Court's decision, employees who were EPS members as of 1

September 2014 might choose to make larger pension contributions based on their

real salaries rather than the statutory wage ceiling of Rs 15,000 per month.

According

to the EPFO's February 20 guidelines, qualified employees who had previously

declined to choose larger pension contributions under EPS may now do so. The

factors listed below, however, may make you want to reconsider choosing the

higher pension contribution.

1.

The

PF account's funds will "fly away" - The major disadvantage of choosing the Higher Pension is that,

starting from the date of joining, a portion of your EPF corpus will be shifted

to the EPS scheme in order to permit a Higher Pension. The benefit of

compounding that you may have accrued over the years as an EPF member will be

lowered by the transfer of EPF funds to EPS. Therefore, you should conduct a

thorough evaluation before choosing the higher pension option.

2.

The entire balance of your PF account won't be paid out - According to current PF

regulations, your nominee (wife and children) will receive the entire amount

placed in this account in the event of any unfavourable events. However, in the

case of EPS, the wife will only receive a 50% pension while you are away. This

means that if you receive a pension of Rs. 20,000, your wife will receive 50%

of it, or Rs. 10,000, and your children would receive 25%, or Rs. 5,000.

3.

Lack

of a lump sum withdrawal option - There is no lump sum payout from

EPS. On the basis of your collected corpus, it grants you a pension. Consider

other government-backed choices like NPS, which will offer market-linked

returns plus a lump payment for purchasing an annuity at retirement, as an alternative

to choosing a greater pension under EPS. Additionally, NPS contributions offer

a deduction of an additional Rs 50,000 over the Rs 1.5 lakh allowed by Section

80C.

4. IN EPS SCHEME YOU GET LESS INTEREST -

The EPS programme is not flexible. Additionally, EPS does not earn the same

interest as EPF, which is typically higher.

5.

unable to take an early retirement -

Choosing EPFO's Higher Pension may not be a good idea for individuals

considering an early retirement because EPS pension eligibility is only granted

after 10 years of work and 58 years of age.

6.

Taxation at maturity –

The corpus received at maturity that is used by the NPS account holder for

buying an annuity is taxable under this plan. The Government of India levies

tax on 60% of NPS investment, while the remaining 40% escapes the taxation

amount

Disclaimer: The article is only for educational purpose

- Kain

Tuesday, 2 May 2023

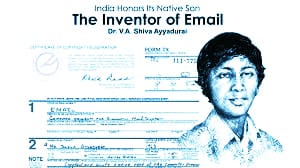

Do You Know The Indian-American CHILD Who Invented E-MAIL : V A Shiva Ayyadurai

V. A. Shiva Ayyadurai, an Indian-American who at the age of 14 created E-Mail

On August 30, this year, email turned 41. However, how many of us are aware that V. A. Shiva Ayyadurai, an Indian American, devised this rapid mode of information transport when he was just 14 years old?

Ayyadurai developed "email," a computer programme, in 1978 to mimic all the features of the inter office mail system, including the Inbox, Outbox, Folders, Memo, Attachments, Address Book, and others. These functions are now common place components of all email systems.

The US government recognised Ayyadurai as the creator of email on August 30, 1982, by giving him the first US Copyright for Email for his creation from the year 1978. At the time, the only means of safeguarding software inventions was through copyright.

With a sizable research budget, email wasn't developed in major organisations like the ARPANET, MIT, or the military. According to the Huffington Post, these organisations had deemed the development of such a system "impossible" due to its extreme complexity.

Ayyadurai was born in Bombay to a Tamil family. He moved to the US with his family when he was seven years old.

Monday, 1 May 2023

5 Suggestions for TRADERS

1. Wait for good levels before entering any stock at any price after it has been booked.

2. ALWAYS try to book before results if the stock has moved a lot and

you have made a good profit on it.

3. Try to maintain a disciplined attitude to investing, which entails

knowing when to purchase and sell.

4. Decide how much you can lose, step 4. Don't copy other people's stop

loss decisions because everyone's financial situation is different.

(Others have 1 crore, while others have 1 lakh. Decide what you believe

is right for you.)

5. Don't purchase stocks at a set price; instead, hold onto your cash

and profit from price changes. Even if an opportunity passes you by, maintain

your discipline.

Saturday, 29 April 2023

Consider EQUITY To Be Your Third Child

The amount of money parents spend on their children's schooling, extracurricular activities, weddings, etc., is sufficient. About 25 years are needed for this. If you have two children, you may assume you have three. Spend the same monthly money on one child as you do on an equities fund. Repeat for a further 25 years. Whether your real children take care of you or not after 25 years, this third child will take excellent care of you for the rest of your life.

You're probably wondering: Why equity? Why is investing in equity regarded as a low-risk, high-return strategy? You should ask this question, it is nice. Prior to engaging in equity, it is wise to thoroughly understand it.

Let's analyse a straightforward query. What is generally your primary source of income? If you are employed, your salary will be your source of monthly money. Other income from investments or rent if you own real estate that is rented. You make money from your business if you run one.

Who now makes more money is a new question. paid a salary or a businessman? Yes, of course! Businessmen. There are no salaried individuals on the list of the richest people in the world. How do these businesspeople make money? Consider this. In order to operate a business, you must cover costs such as the employee's wage, office rent, loan repayments, power, and other expenses. What businessmen get after conquering all of these challenges is a profit. Additionally, this profit fluctuates every month. Although there are good and bad months, on average, a business makes more money.

The point is that running a business can help you become wealthy. Nothing but a business is equity. A group of these operating enterprises is an equity fund. The business has its ups and downs, including equity. Similar to how you can lose money in your firm, equity funds can also lose money occasionally.

Even if you choose not to manage a business, you can still make money by investing in equity funds that do so. You get higher returns from equity funds than from fixed deposits.

Let's use the scenario where someone starts working at age 25 and retires, say, at age 65. To save for your retirement, you have 40 years. Let's say you save $1 annually in fixed deposits that pay you 7.2% interest. It will take ten years for your money to double. Thus, after 40 years, you will have 16 dollars. However, if you invest the same $1 into equity, which yields 14.4% returns, your money will double in value within five years. Therefore, after 40 years, you will have 256. Major difference

Wednesday, 26 April 2023

REMARKABLE STORY: Satyanarayan Nuwal (SOLAR INDUSTRIES)

Meet Satyanarayan Nuwal, who went from sleeping on railway platforms to building defence equipment worth Rs 35,800 crore.

Satyanarayan Nuwal was up in the Rajasthani village of Bhilwara, where his father worked as a Government Accountant. He was more concerned with learning about business than he was with receiving a regular education. So, after completing his Tenth Grade, he spent a year with his guru and tried his hand at business.

At the native and immature age of 18, he made an attempt at a little chemicals and trading company, but it wasn't very successful. At the age of 19, Satyanarayan Nuwal got married and stayed in Chandrapur, Maharashtra, where he battled until 1977.

The period Satyanarayan Nuwal spent at Chandrapur was difficult. He frequently slept at Railway Stations since he couldn't afford to buy basic necessities. He never gave up hope, though, and it was this unrelenting attitude that brought him into contact with Abdul Sattar Allah Bhai. Although he had an explosives license and a magazine, he had no special interest in exploiting these resources to run a business.

However, Satyanarayan Nuwal saw a business opportunity in this.

Saturday, 22 April 2023

ERROR THAT “KILLS” TOO MANY TRADERS: And How To Fix It

Most new traders look for the “secret weapon” that will help them to successfully trade the markets.

They want that system or indicator that will eventually lead them

from where they are, to where they once dreamed of.

But if you’ve already got some time in this business of trading,

you may have noticed that there is no secret.

And those who have more experience, know that the only (simple but

hard) way to reach consistency is by:

1. Having the discipline to develop a system that fits your risk

profile

2. Having the discipline and patience to follow your system

3. Develop a risk management plan (trade size and risk per trade)

4. A plan to manage your trades

5. Do not take unnecessary risks!

With patience and persistence, by following each one of these

steps, undoubtedly you’ll reach your goals. Just focus on each of these

aspects, and the results will come by themselves.

But there is a common mistake among traders… A mistake that I did

fall prey of: Distraction.

Every day in forums, blogs, trading magazines, etc. traders write

about new strategies, indicators, mathematical formulas promising returns never

seen before.

The problem is, that in each one of these blogs, posts in forums,

magazines, each strategy or indicator or system they talk about a different

thing… So at the end of the day, you have 1000 “different” new strategies or

indicators.

Then we try some of these strategies, or try some

indicator…Sometimes we test it for a few days, some others a few weeks or even

some months…

And guess what happens next?

Almost all of the time it turns out to be not such a good idea

(that same idea that seemed so great at the beginning).

WHAT IS THE RESULT THEN?

Loss of our precious time… sometimes we don’t realize how

important time is for us, specially as traders.

This happened to me traders at one point, and not infrequently! To

some extent, I think it happens to many of us.

We see something new, we “dazzle”, then it comes the phase of

“romance” where we see the potential, then we try it, and in the end, we see

that the results looked far better on hindsight.

Now, don’t get me wrong … Not everything we try is a bad idea! In

the end, these “tests” help us come up with a functional system.

What I’m saying is that most of these “new things” only make us

waste our time, therefore, we must have a way to differentiate what things to

try and which ones to better forget.

So we cannot be wasting our time every day, because this diverts

us from our primary plan, and if we keep trying new things every day we’ll

never achieve our main goal.

So, what can we do to avoid this mentality to “try everything we

find online”?

I call it: The 2 Weeks Rule

THE 2 WEEKS RULE

Every day we operate the system that we feel more comfortable,

confident, etc.

Whenever you see something new you think you “have” to try. Put it

in a list, and keep thinking about it for a week.

If after a week, it still sounds like a very good idea, and still

think it’s worth trying it, starting on the second week, dedicate to it an hour

a day. See the results on hindsight.

If you still think its worth trying it, then it is time to give

this new “thing” formality and add it to the system or methodology you’re

currently following.

I think this will help you a lot, but more important than anything

else, it will save you valuable time. It will keep you from the “try everything”

mentality.

HOW CAN THIS HELP YOU AS A TRADER?

Eliminate distractions, and keep trying to reach your main goals.

Stop trying all new indicators, strategies, systems, and focus

only on what is worth using The 2 Week Rule.

Manage your time, is the most valuable resource, remember lost

time never returns.

Stress in trading is a sign that something is wrong. If you feel stress, think about the cause, and then act to eliminate the problem.

Details Required To Income Tax Return For The Financial Year 2022-2023

2. Aadhaar card

xerox

3. All Savings

bank and Current account statement

4. All Bank

Deposit Details (Fixed or RD A/c)

5. Post office

SB Account, RD Account, and Fixed Deposits

6. Bank Jewel

loan Statement

7. Housing loan

Statement

8. Vehicle loan

statement

9. Land

Documents (Purchase and Sales)

10. Vehicle RC

Book xerox (Purchase and Sales)

11. LIC and

Insurance Premium paid receipts or Premium paid statement

12. Mediclaim

Insurance or Health Insurance

13. School fees

paid receipt

14. Jewel

Purchase Details

15. Investment

in other firms or companies

16. Details of

Share Investments

17. TDS Details

18. FORM 16A

(For Salaries Persons)

19. ODCC

Account and Term loan account (For Business)

20. Expenses,

Purchase, Sales, Receipts, Credit note, Debit note (Business)

Tuesday, 18 April 2023

Why The Lion Rules The Jungle ?

In the jungle which animal is the biggest of them all ?

I heard you say the Elephant.

Which animal is the tallest ?

I heard you say, the Giraffe.

Which animal is the wisest ?

I hear you say the Fox.

Which animal is the fastest ?

I heard you say the Cheetah.

Among all these wonderful qualities mentioned, where is the

Lion in the picture?

And yet we say that the Lion is the king of the jungle.

Why ?

Because the LION is courageous.

The Lion is Bold

The Lion walks with confidence

The Lion is Fearless

The Lion dares to go above and beyond and he is

never afraid.

The Lion is unstoppable because he believes in himself.

And the Lion make the most of every opportunity he gets, he never let's an opportunity slip from his hands.

So what can we learn from the Lion today ?

You don't need to be the fastest,

You don't need to be the wisest,

You don't need to be the smartest,

Or the most brilliant.

All you need is courage, boldness, the will to try and to

believe in yourself.

It’s a winning mindset, that’s all it takes.

10 Best Highest Paying Dividend Stocks, Given Upto 31% Dividend, Vedanta & Hindustan Zinc Are In Top

10 Best Highest Paying Dividend Stocks, Given U pto 31% Dividend, Vedanta & Hindustan Zinc Are I n Top VEDANTA Mining company VEDAN...

-

Specialised & Better Quality Lamps by IndiaN Firm “Electricity is next in importance to food, shelter and clothing. The demand fo...

-

Indian independence warrior MATADIN VALMIKI was instrumental in the events that took place just before the Indian insurrection of 1857 beg...

-

फांसी की सजा उन्हें सुनाई जाती है जिन्होंने जघन्य अपराधों किये होते है। किसी अपराधी को जब फांसी की सजा मिल जाती है तो कोर्ट में बैठे जज...